A last will and testament is an important part of the estate planning process. Its use is for people of all ages and walks of life. Not just for people who are in poor health, or in a near-death situation. If you want to plan for what will happen to your property, finances, children, and even pets in the event of death, it is important to consider having a will drafted today.

If you have a very simple estate, then a basic will can suffice. But, If you have questions regarding the details surrounding:

Then you would likely benefit from having a conversation with an estate planning attorney.

You should know that there are many reasons for making a will. If you die without a will, you are leaving an important decision up to the local court and the laws of your state. You have very little, to no say, in determining who receives your property and other assets. Also, after your death, it can be more difficult for loved ones not to have a will, as it can lead them into a complicated process.

Almost all properties must go to probate court, unless they are secured in a trust. The probate process is a judicial process to oversee the distribution of assets. Probate court can be lengthy, stressful, and very expensive.

Without a will, this process becomes especially complicated. The court must appoint a personal representative to manage your estate. And this can be time-consuming, expensive, and even controversial for your loved ones.

One of the main reasons for a will is to expedite the inheritance process. When you have a will, you can choose the person who will manage your estate planning needs to make it easier for everyone.

There will never be a “perfect time” to make a will, which is why it is so important to start working on a will now. Your will not only distributes your assets, but also appoints guardians and executors of your estate, makes provisions for businesses, establishes charitable donations, and plans for taxes or other administrative costs.

On top of that, writing a will with a trusted attorney or law firm can save your family hours of arguing and lengthy litigation down the road.

Schedule Your Free Consultation.

You should write a living will because it can be helpful to your healthcare practitioner and your family. It helps guide them through making medical decisions if you cannot speak or think for yourself.

Without a living will, it places the responsibility of making the final choice of your medical care onto your family members.

Making your own will in Nebraska is possible, but we urge you to just have a conversation with an estate planning attorney. A simple conversation can leave you with more peace of mind that your estate is prepared to cover all the details.

Estate planners can provide legal strategies that help you avoid sticky situations.

Unless you’ve prepared ahead of time, your estate will be distributed in accordance with Nebraska inheritance state law. As we stated before, probate can be a costly process and estate planning helps properly replace the terms of the state’s standard process with your own.

We are here to help you. Please contact Heritage Law and start planning for the future today.

We work one on one with you directly to ensure your family estate planning process is completed from start to finish.

We ensure the future plan we put in place makes the most financial sense for your property and your family long term.

We take our time to explore all available options as we strive for excellence. We work hard so you don't have to.

It’s important to consider your own personal situation. There are often different approaches depending on your specific needs. For example, if you do not have children or dependents, you can approach the process in a different way, focusing more on the distribution of wealth.

But in Nebraska, a married person must make alternative arrangements for the children. Nebraska law favors spouses when it comes to inheritances. When you don’t leave behind a valid will or the will is not finalized correctly and therefore not legally binding, children can often be left without property or money.

There are many details that can complicate matters as time goes on. Professional help can allow you to make more sense of things like handling estate tax, caring for minor children, preferential treatment for specific heirs, handling real estate, the existence of multiple retirement accounts, and even burial instructions can all be considered.

You can also make a new will containing the terms that revoke the previous one or that have different terms from the old one, Neb. Rev. Stat. § 30-2332.

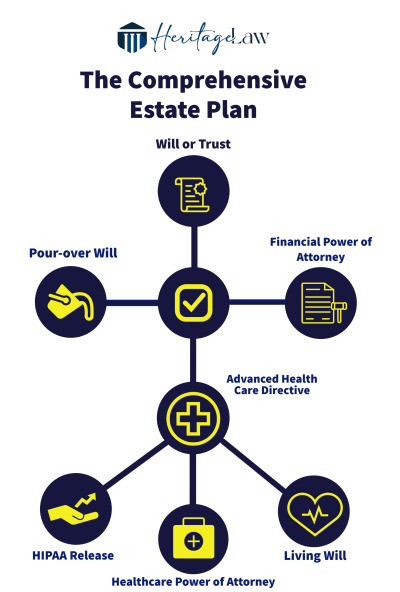

A comprehensive estate plan can help you look to the future with more confidence, knowing that your loved ones are cared for and that the legacy you leave is what you want. Thoughtful planning now can help minimize estate taxes and fees and ensure your family has less to worry about when you are away. However, not planning for your estate can create unwanted complications for your successor.

If you have questions about creating a will or how you want to leave assets? If so, we’d love to speak with you. Working with an estate planning attorney has helped many people leave their legacy behind with more confidence.

At Heritage Law, we can help provide you with legal and financial expertise to protect your family and assets for the future. Working with a professional can save time and provide useful advice on creative strategies that could end up saving you a lot of money in the long term. What are you waiting for? Schedule your free consultation today!

Get in Touch

Or send us a message and we can help you.

Heritage Law is a comprehensive estate planning practice that is based in Omaha NE and services clients across Nebraska and Iowa.

We will put together a thorough estate plan for you, complete with options that advance the goals you’ve set and keep your wishes in mind. We bring years of experience and knowledge to ensure your estate plan covers every need from start to finish.

© 2021-Photon SEO